The most anticipated secret festival of the year returns to one of the most paradisiacal islands

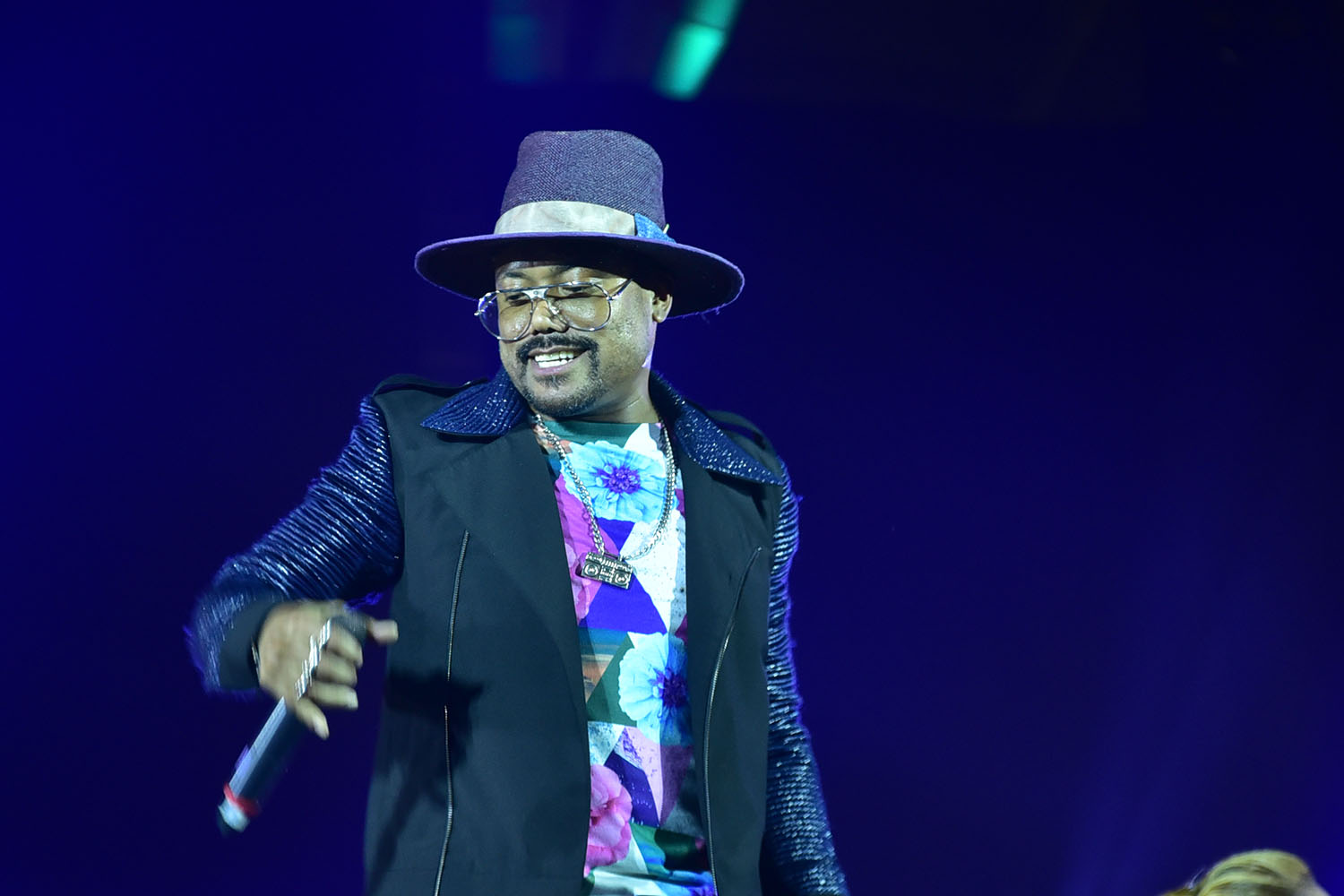

A surprise musical line-up, haute cuisine, commitment to positive impact and the best beer will meet again in Formentera from 6 to 8 October at SON Estrella Galicia Posidonia, an exclusive experience only for 350 lucky people