This simple yet genius hack makes an artificial olive tree look so realistic

We are gripped by this faux olive tree hack making the rounds of the internet

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

REAL ESTATE

EVENT

EVENT

LANDSCAPE

LANDSCAPE

LANDSCAPE

LANDSCAPE

CONCERT

CONCERT

LANDSCAPE

LANDSCAPE

TRAVEL

TRAVEL

REAL ESTATE

Residential, Commercial, Interiors

LANDSCAPE

Landmarks, Cityscape, Urban, Architectural

FOOD

Hotels, Restaurants, Advertising, Editorial

PORTRAIT

Traditional, Glamour, Lifestyle, Candid

PRODUCT

Studio, Lifestyle, Grouping

EVENT

Conference, Exhibition, Corporate

FASHION

Portrait, Catalog, Editorial, Street

TRAVEL

Landscape, Cityscape, Documentary

SPORT

Basketball, Football, Golf

CONCERT

STILL

STREET

Interior design tools are everywhere but if you’re just starting and you want to show your client a mock-up of your thoughts then where should you begin?

I’ve compiled a list of the best 25 interior design tools, software and apps that you will be able to virtually pick up and use instantly without a large learning curve.

It doesn’t matter if the client is looking to remodel their kitchen, redesign their whole floor plan or just restyle their living space. These interior design tools can communicate your room layout ideas quickly with a high level of precision with high-quality room designs.

The home design tools you use may not be part of your business plan, but using computer programs for interior design can go a huge way to how you communicate and showcase your skills to clients.

Take a look at some of my best interior design softwares for interior designers…

Foyr Neo is a cloud-based and highly feature-rich interior design software. It has a variety of tools dedicated to different interior designing processes like mood boarding, building floor plans, selecting and organizing design elements and visualizing the final output in 3D.

The efficiency and effectiveness with which Foyr Neo’s various tools perform complex tasks like rendering designs and creating 3D walkthroughs will enable you to direct all your attention to the client-facing aspects of your business, thereby helping you delight existing clients and acquire new ones. In a nutshell, you can focus on growing your business with Foyr Neo helping you manage your administrative, day-to-day operations. Let’s look at some of Foyr Neo’s standout features –

Foyr Neo’s AI-driven, cloud-based rendering system allows you to render your design in photo-realistic details within minutes. The auto-lighting and auto-material features ensure the perfect selection of design elements, saving valuable time in manual searches for materials.

With over 60 K plus furniture, lighting, materials and textures to choose from, you will be able to find exactly the elements you envision. Looking for a ‘light pink velvet’ fabric texture? Just put in a query on the search bar and see exactly what’s on your mind, pop up!

Foyr has 2000+ high-quality, render-ready design inspirations you can choose from. Drag-and-drop elements from a design or extract the entire inspiration to the Foyr Canvas. Customize as per your client’s requirements and generate renders or walkthroughs. And that’s it! Reduce design time by 75% with this functionality.

Foyr boasts of the most interactive and intuitive UI amongst its competition. You can switch between 2D and 3D with a click, drag and drop products with ease, and select and apply textures in 2 clicks among many such smart functionalities. Customize your experience and create your workspace on Foyr’s AI-driven Canvas!

Foyr allows you to create an immersive, panoramic 3D walkthrough of your design in a jiffy.

Experience the magic of augmented reality! With our AR view feature, you can now place NEO products in real-life settings, offering a level of immersion that was once unimaginable. Showcase your designs in an entirely new way.

Cost: free version, paid for all features

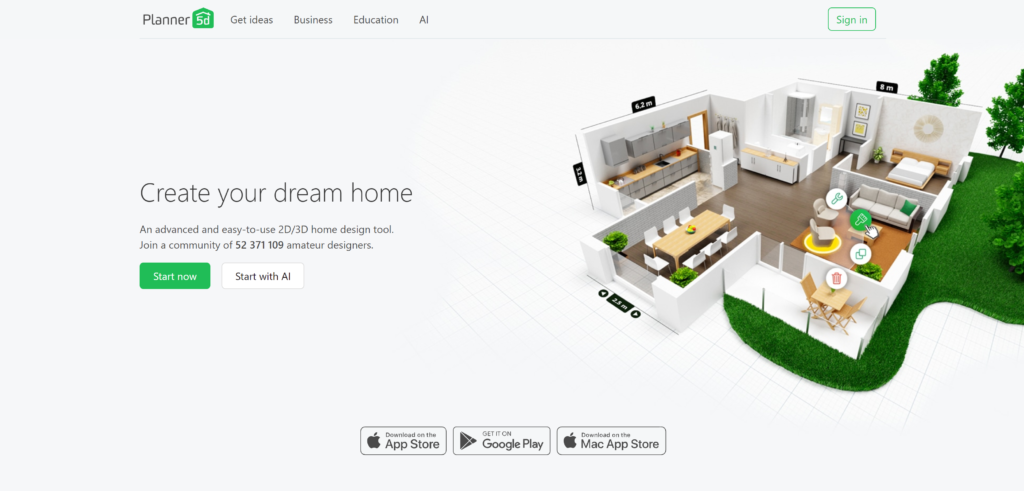

Planner 5D is generally considered the #1 virtual room designer that not only lets you design the interior but also lets you explore your virtual house as if you were in the floor plan.

Easy-to-use, Planner 5D is also ingrained with drag and drop functions. You can easily build and move walls, add high definition items, and pick the building materials, colours, and sizes of those items. To smooth your design process, you can toggle between 2D and 3D design rendering depending on your preference. Once you are done, you can save the rendered photos of your interior and share them.

What’s also nice about this app is you can use it on iOS and Android devices. That way, if you don’t have much time, you can plan your interior design on the go.

Planner 5D is one of the easiest to use and best looking interior design rendering software around—it’s amateur friendly, making it an excellent starting point. The only downside with this app is that if you want to save photo-realistic rendered photos of your design, you need to pay the appropriate amount. However, unless you are professional, most people won’t need the feature as you can still save regularly rendered photos.

Cost: paid (free trial option)

Cedreo is an online 3D home design platform used by professional home builders, remodelers and interior designers to create 2D and 3D floor plans, including both the interior and exterior renderings.

The software is intuitive and easy to use, and helps users quickly create photorealistic interior designs using its library of 7,000+ customizable pieces of 3D furniture, materials and decorations.

Designers can quickly show prospective clients exactly what their finished project will look like, and as a result, close more design contracts in less time.

Cedreo’s platform is 100% cloud-based, so you can meet with clients and make edits to designs and proposals on the fly.

Cost: free

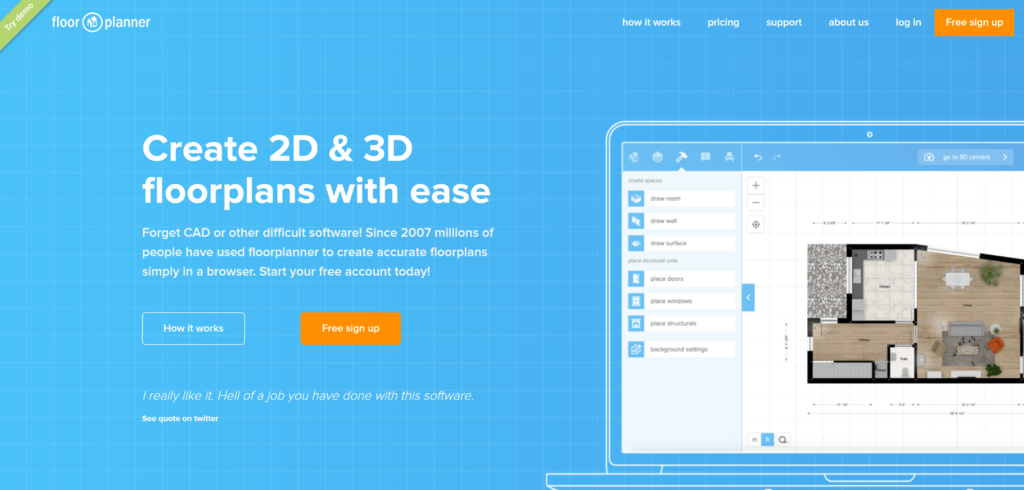

If you want to design your interior online without having to download any application, then Floorplanner is an attractive choice. As the name suggests, the core strength of this software lies within its excellent feature as a floor plan software.

Though rest assured, the app interior design function is also pretty good. You can flexibly design the floor plan of the house, put objects such as furniture & windows, and view the real-time design both in 2D or 3D.

As free design software, the fundamental features in the app are included. But, should you choose to go premium, you can get the ability to see your design in High Definition (HD) instead of Standard Definition (SD) and add more floor plans or room designs to a single project. Basically, the professional’s stuff.

Otherwise, the free version should just be enough for your design needs.

Cost: free

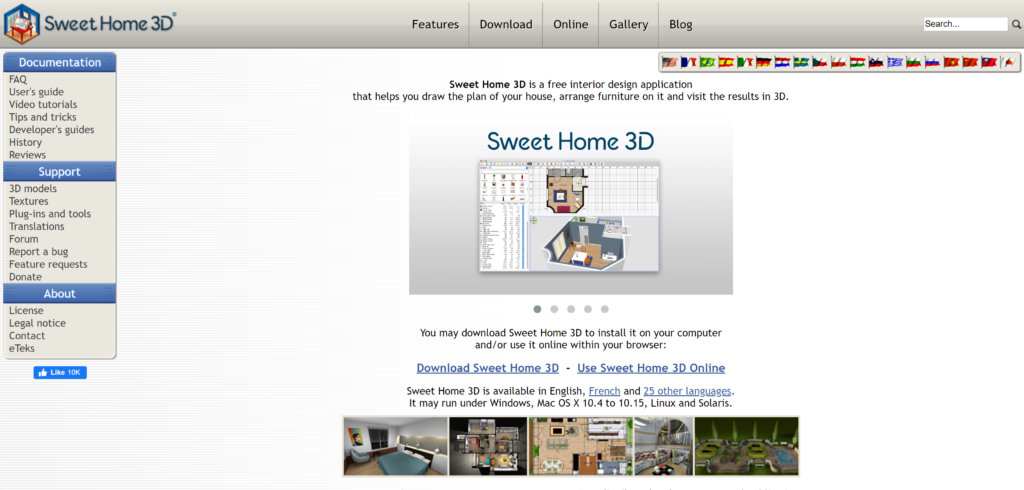

With Sweet Home 3D, you can use a vast amount of objects in the application library to help you better simulate the house’s interior design style. Simply drag and drop the objects that you want, and you are good to go.

There’s also freedom when determining the floor plan of the house—you can even layout an irregular wall shape. No prior technical design skills or knowledge required. You can easily master this software in a short period of time.

To start with, you can choose the available layout design first to build your confidence—similar to Planner 5D, then start building the walls. Else, you can opt to design the layout from scratch too. Afterwards, you can drag and drop objects such as doors, furniture, and windows. Additionally, you can also edit the colours and sizes of objects.

The great thing about this software is that you can draw the walls in a 2D medium, but the simulated 3D will appear in real-time as you draw the wall.

After you’re satisfied with the design you’ve created, you can take a virtual 3D tour to better view every nook and cranny of the virtual interior. If you want to turn them into photos or videos, that’s also doable.

Cost: free for personal use

Roomeon offers extensive features you can take advantage of. Like the interior design software mentioned above, it also provides an array of objects and rotates functions for a decent viewing experience. There are three types of viewing cameras to choose: person camera, free camera, and satellite camera.

As a realtime interior design app, Roomeon lets you create room designs in 3D with ease and quickness. There’s also “Create the Mood” feature useful for simulating how different time of the day affects your interior looks. The design process is easy and intuitive, which makes it a great option for all level of interior designer.

Another great thing about this app is you can furnish your virtual home with furniture from real-life brands such as IKEA and Claude Monet.

Cost: paid

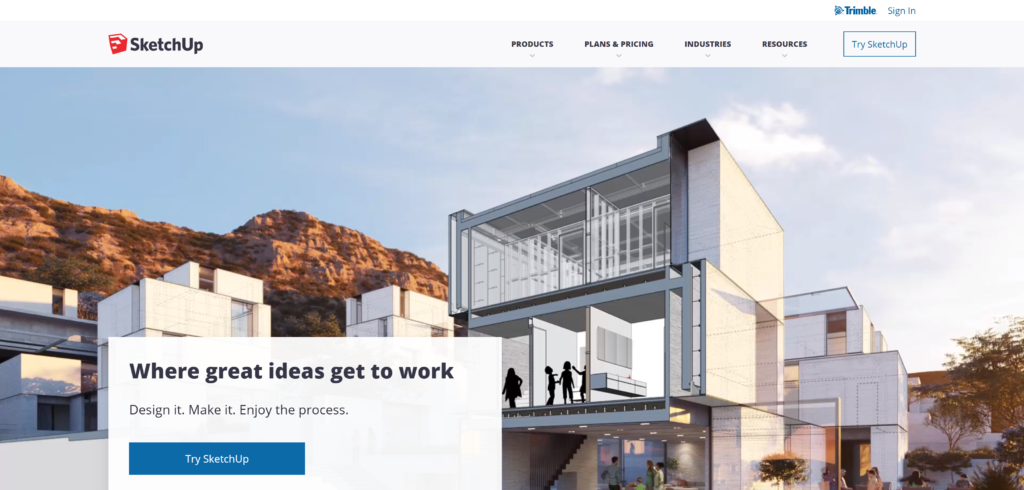

Sketch Up is one of the most powerful interior design tools offering comprehensive 3D capabilities. The flexibility of the software makes you feel like you are drawing by hand. Sketch Up is an online web app, so you don’t need to download it.

You can add objects to your room layouts and customise them. However, you may have to download the objects you want to use first so a good internet connection is needed to run the app smoothly. But overall, it’s quite a handy app.

Sketch Up can be used for free. Nevertheless, with a premium subscription, you can get your hands on additional tools such as Augmented Reality (AR) viewing.

Cost: free

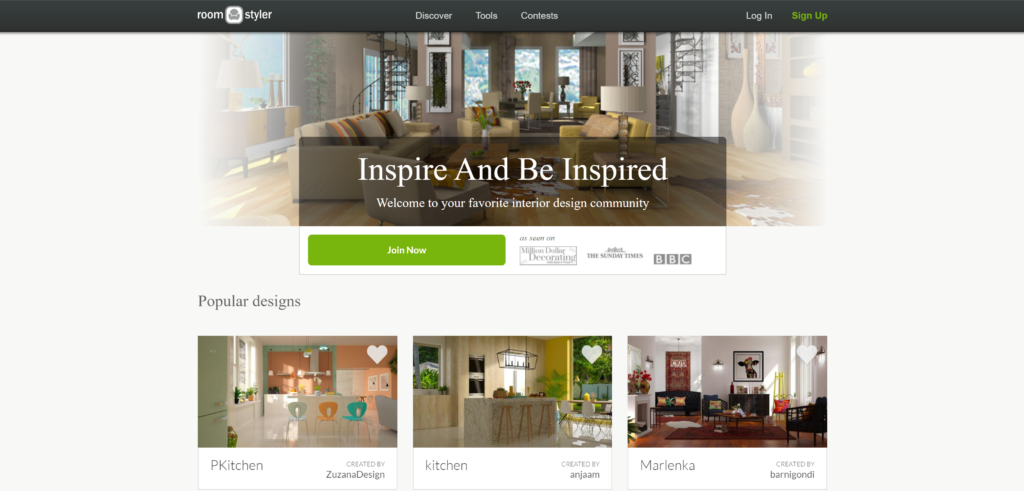

Like Roomeon, Roomstyler is a very intuitive app that you can pick up and master relatively easily as an interior designer. There’s a very good playlist of tutorial videos that you can watch but even then, you may not need it since you can learn as you go with ease.

To start using it, simply design your interior from scratch—no need to worry even if there’s no template. You can simply start dropping items like walls & windows and you can see the result instantly both in 2D and 3D. Like always, you can customise them in terms of colours, sizes, or placements.

The option to furnish the interior with real-life products is also another great perk of the app. With this feature, you can more easily imagine how certain appliances you plan to buy will look in your new home.

Cost: free

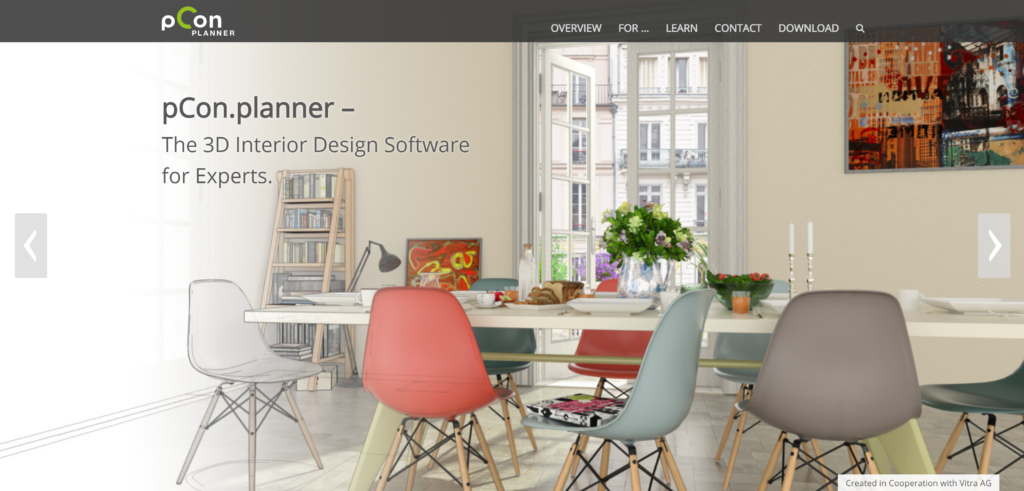

pCon.planner is a completely free app for any use—whether for personal designs or business. Despite being 100% free, the vast amount of features that it has can’t be taken lightly. You can find a big amount of objects to make use of inside the app library.

The app is relatively straightforward to use. However, if you find yourself confused about where to start, there is a considerable amount of tutorial videos you can watch beforehand. After you get the hang of the app, you will see it’s listed as one of the best free design software apps as it offers a lot of tools equal to some of the paid apps.

Not just for casual, pCon.planner also provides a great option for commercial uses. For instance, you can load CAD models in various formats like DWG and 3DS to the app with ease.

Cost: free for personal use, paid professional version

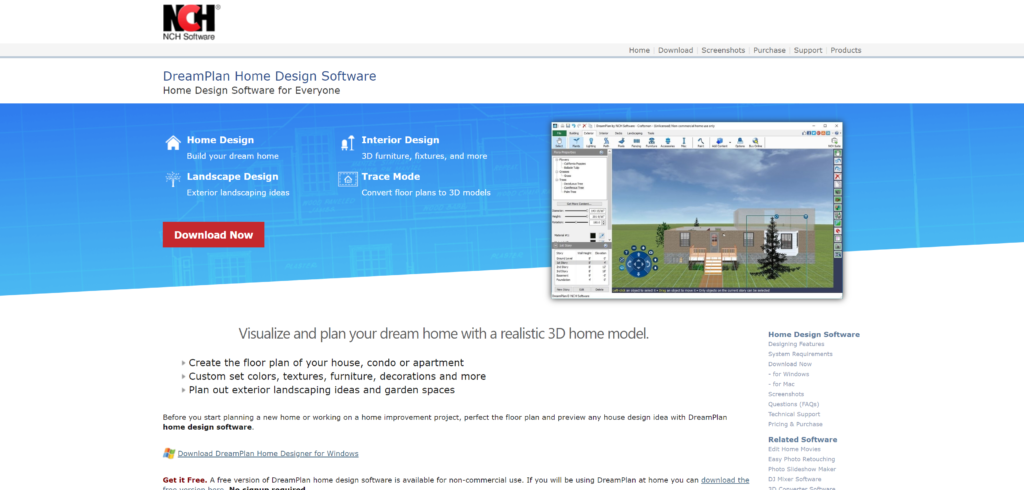

DreamPlan is an excellent low-profile app perfect for personal use. The software comes with a huge array of objects to choose from and has a decent UI. You can also resize and rotate any object to fit your design. If you want, you can include multiple stories or floors to your project and design each interior separately.

When you first open the app, you can opt to view some sample projects and edit them to ‘get your feet wet’. Furthermore, tutorial videos for each of the object’s type are also available. Luckily, the app is simple enough so you don’t have to worry too much about getting stuck.

The free version of the software is not for commercial use, unfortunately. There is a paid version of the app with more features should you want it for business purposes.

Cost: free basic version, paid

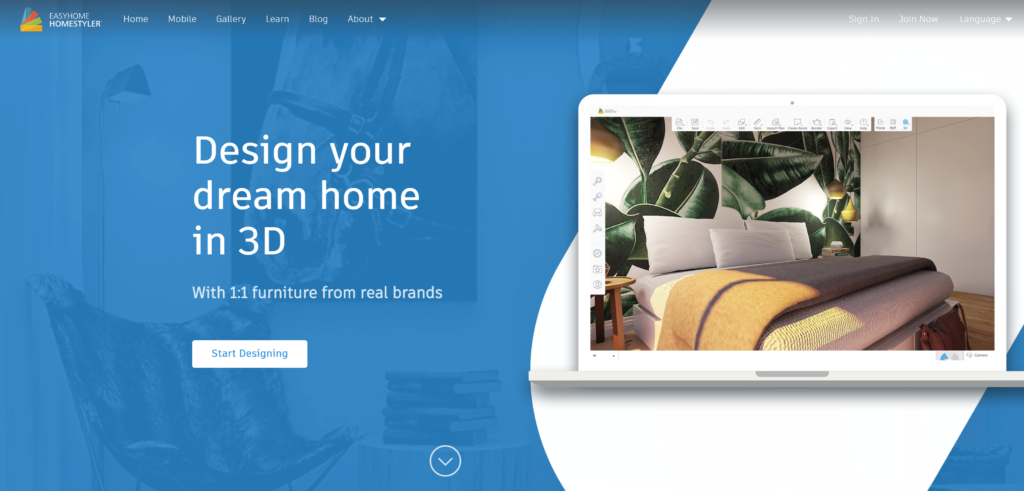

Homestyler is a user-friendly app originally created by Autodesk, the software corporation behind AutoCAD. Now owned by Easyhome, Homestyler isn’t a professional design program like AutoCAD, instead, it was created exclusively for home design needs. You can easily make floor plans and angled walls or place numerous objects.

To start building projects, you can pick either to edit some demo projects, pick a design template, or start from scratch. If you are new, you may want to view a demo project instead. You will soon see that the app is truly intuitive and simple to operate.

We regard Homestyler as one of the best free interior design software choices for all-around utility. There’s also the pro version if you want to take advantage of the app’s full version.

Cost: free

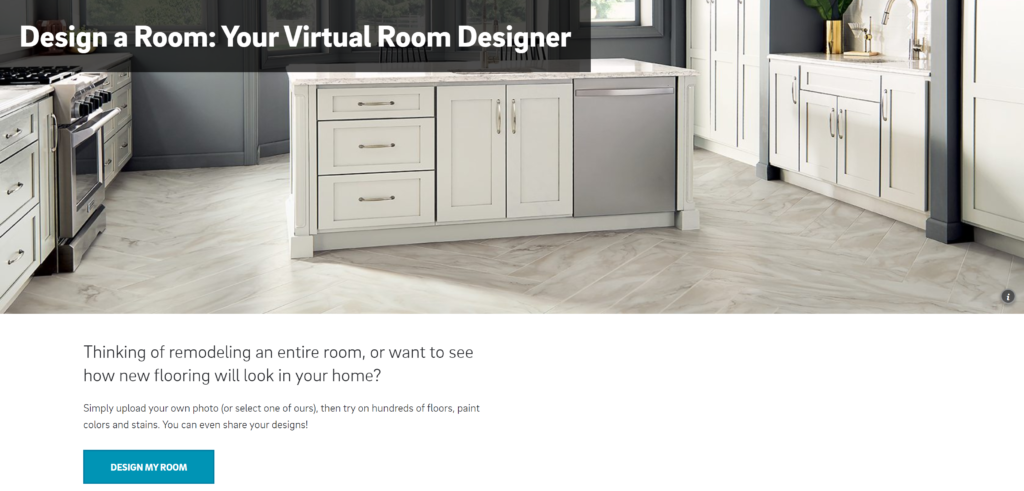

Design a Room by Armstrong Flooring is an excellent pick if you don’t want the hassle of designing a room from scratch. The way the app works is a bit different from all the other software we mentioned.

To begin designing a room, you can simply upload a photo of your existing room in your house or select one from hundreds of the available template photos. For example, you can choose to edit a dining room with a country style. After that, you can change the flooring, wall paints, or stain of the furniture.

The biggest downside of the program is you can’t customise any of the objects in your room except for floors, wall paints, and stains. However, Design a Room is a great app for those who want to try out a simple new look to their interior.

HomeByMe is an online room planner allowing you to very easily draw 2D plans, get 3D plans and photo-realistic renderings to showcase both old and new properties.

HomeByMe includes a community of users who share their own interior design projects. The software is free for the first projects you plan. You can visualise your design choices in 3D and 2D renderings, and create a shopping list for the things you need to do the design in your home.

Infurnia is a web-based interior design software. It brings the power of professional native design software to the web and adds a lot more collaboration & management functionality on top of it. It’s one of the most feature-rich web-based software available in the market.

Infurnia can be used for all phases of an interior design project: from detailed 2D floor plan creation to auto-conversion to 3D; from drag & drop furniture to creating custom designs; from high quality renders to BOQs & production drawings; from web-based design shares to seamless integration with Infurnia’s virtual reality app. Infurnia’s design tools feature smart placement, collision avoidance, and lots of customisation options.

The design features of Infurnia are free to use, however with the paid plan you can get catalogue management, multiple user accounts, access management, custom pricing tools, and more such features.

Interior Design 3D is an automatic program for preparing 2D blueprints and 3D house plans. It was designed to ease the drafting process for DIY enthusiasts and beginners in home renovation. That is why it is super intuitive and allows making precise floor plans for rooms, apartments, houses, and offices in little time.

With this interior design 3D software, you can design a floor layout from scratch, tweak up the existing one, or edit a ready-made template from the program’s collection to the needed dimensions and style. In the editor’s library, you will find everything necessary for planning a complete renovation or construction – all kinds of doors, windows, and staircases; 700+ pieces of customizable furniture, and decorative materials like wallpaper, tile, laminate, etc.

Once you have finished drawing your 2D blueprint and feel satisfied with the 3D interior design, you can use the Virtual Tour feature to walk around your future home. That way you’ll make sure the place speaks the desired vibe and captures some angles for your contractor to consider. Interior Design 3D is compatible with all Windows PCs – both new and old. Try the program for free and experience its capabilities yourself!

Indema is a game-changer when it comes to running your interior design business. From handling your project management, finances to your product sourcing and human resources (because you’ll be hiring in no time once you start using Indema). It’s a platform created by designers for designers with the sole goal of making it easier to run and grow your design business and let you spend more time on what you do best, designing. And not on those admin tasks that suck time away from the good stuff.

Cost: free

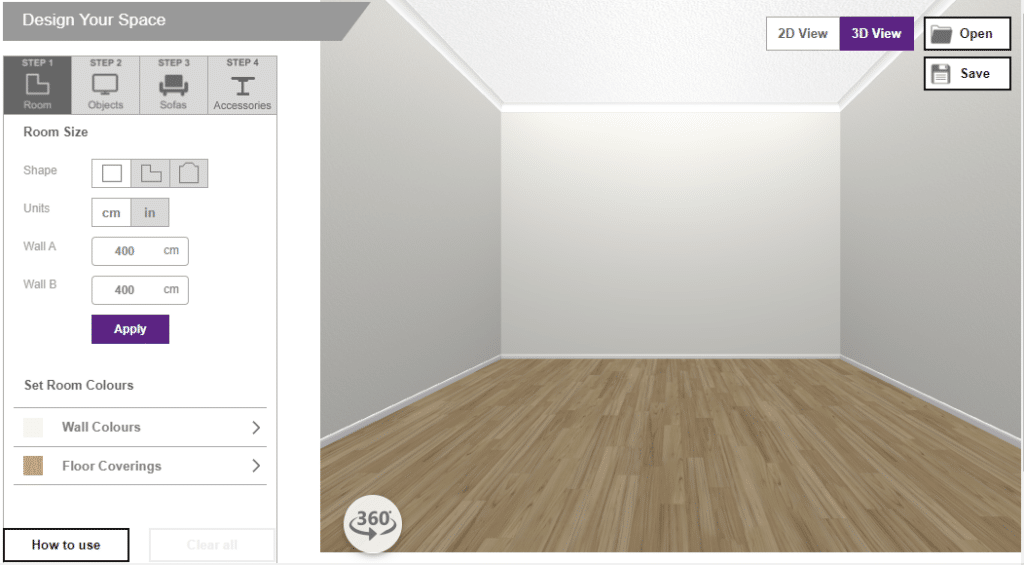

Mainly designed to help you with living room design, the DFS Room Planner is also a great free tool for other rooms too. With an easy 4 steps to designing your space, you can create 3D renderings of key rooms and as it’s by DFS, the emphasis is on making you select the perfect sofa for your home.

Cost: paid

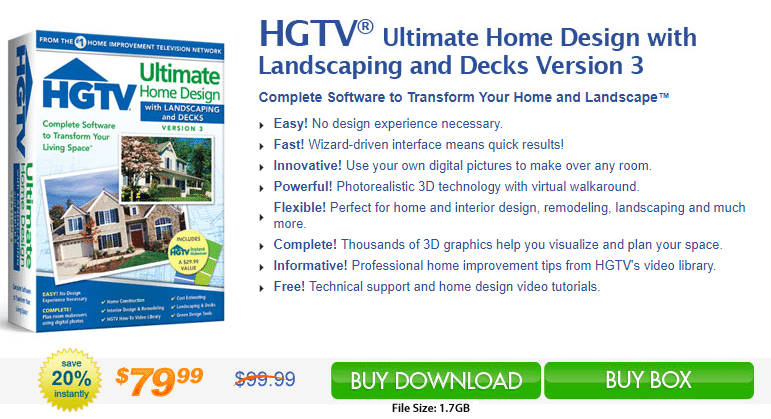

With this complete software for your home and garden, this interior design program will transform your living space. With powerful tools and endless inspiration built into it, it’s the expert help you could need to get the job done whether for your own home or for your clients’. With this software you can plan room additions, improvement projects, and even add energy-efficient lighting and appliances.

Cost: Paid

Total 3D Home has been designed with those wanting to design the home of their dreams in mind.

whilst it is a paid-for program, it’s on the cheaper end so perfect for amateur designers and those looking to embark on big DIY projects. You can further customise your designs too by importing your own images into your renderings, helping you to incorporate pieces you already have and those you’re looking to buy.

Cost: free basic version, paid pro version

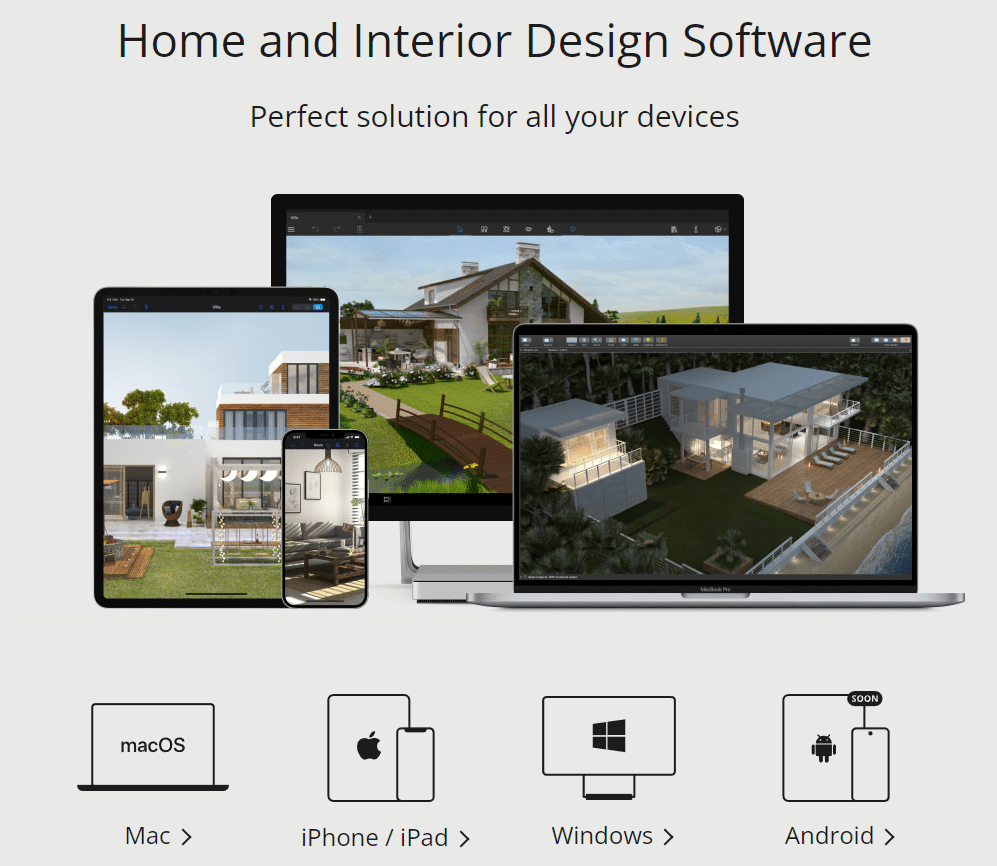

A multi-platform interior design software, Live Home 3D can help anyone create detailed floor plans and 3D renderings. Whether you’re furnishing a room or designing a whole house from scratch, you can easily, quickly, and most importantly, precisely, map out every detail. You can also plan the exterior and adjust the terrain for a fully

Cost: paid

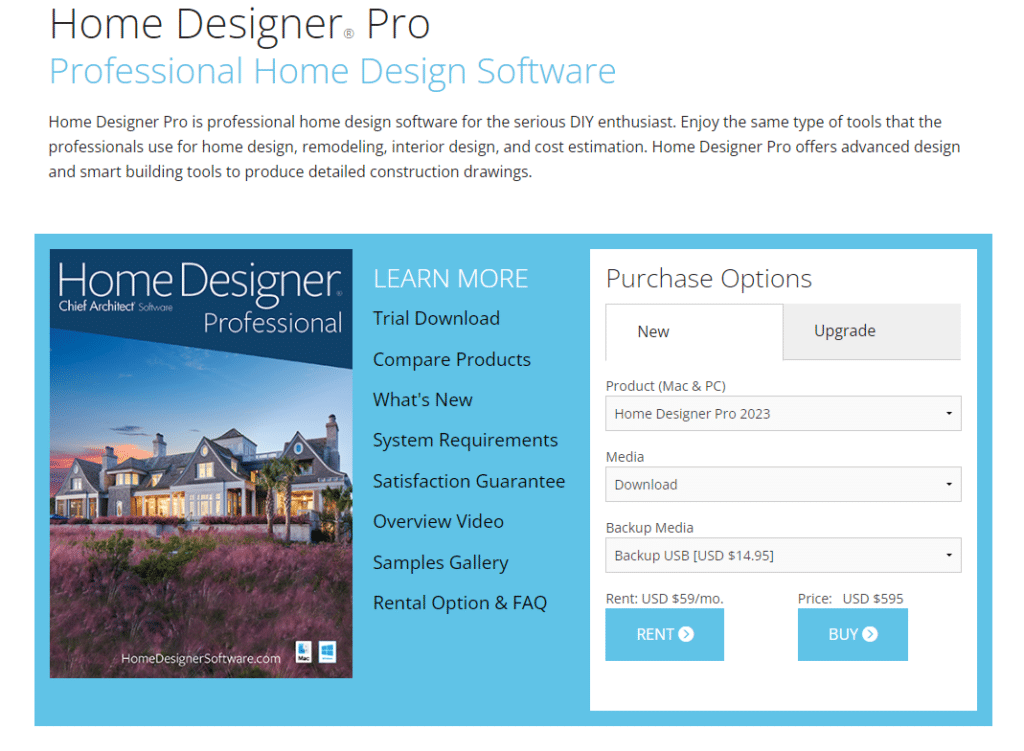

If you have the funds for a paid interior design software program, then Home Designer Pro is one of the best to splurge on. Whilst it does have a steep learning curve, this full suite of industry-grade tools comes with a library of tutorials to help you through the teething process. By the end of it you’ll have the knowledge to create incredibly detailed plans of your entire home.

Cost: paid

This interior design software program centres on floorplans and lets you speedily and easily plan out the rooms in your home in minutes. It effortlessly helps you work out what pieces will and won’t fit in your designs, and you can also add doors, windows, furniture and even appliances to your interactive floor plans.

Cost: free

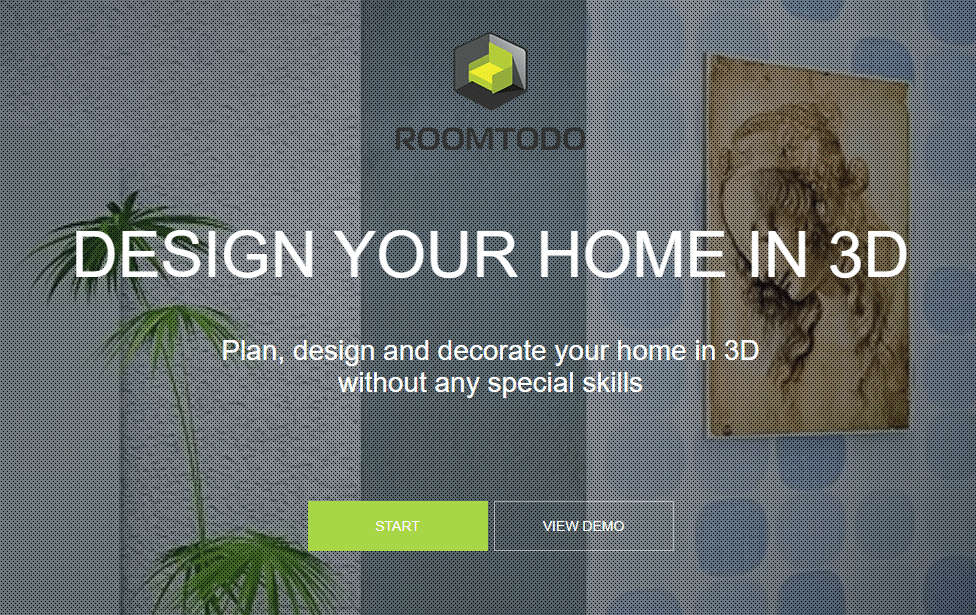

Simple yet powerful, RoomToDo is a fantastic software program for interior design. With 2D and 3D renderings, you can go on a walkthrough view of your design to see it from all angles, create walls with ease and draw over existing floor plans. It may not be as realistic as some of the paid interior design software offerings out there, but it’s a great choice for those who are looking to design small projects in their own homes or for smaller businesses that are just starting out.

Cost: basic version for free, paid personalised version on consultation

Planning Whizz lets you share designs via its cloud-based interface making it an excellent interior design software program for interior design businesses to share designs with their clients. With this tool you can plan, visualise and configure all rooms in the home and the handy shopping integration helps you move seamlessly onto the building stage. There is also a personalised branding option where you can add your logo and other touches to you designs too.

Cost: Free option with limited features, upgrade to unlock the full product

RoomSketcher is the perfect interior design software for anyone looking to design and visualize a home in 3D. With a user-friendly interface and powerful tools, RoomSketcher makes it easy for even the most novice designers to create stunning interior designs.

With RoomSketcher, you can create detailed floor plans, 3D visualizations, and high-quality 2D and 3D renderings. You can also easily customize your design with a wide selection of furniture, textures, and finishes. Whether you’re designing a new home, remodeling an existing one, or just looking to redecorate, RoomSketcher has everything you need to bring your vision to life.

One of the standout features of RoomSketcher is its collaboration tools. You can easily share your designs with clients, contractors, and other collaborators, allowing everyone to stay on the same page throughout the design process.

RoomSketcher can be used on both computers and tablets, making it the perfect tool for designers who are always on the go. This means you can easily work on your designs from anywhere, whether at home, in the office, or on the way to meet with a client or contractor.

In short, if you’re looking for easy-to-use and powerful interior design software, RoomSketcher is the best option.

Want to see your interior design tool here?

Get in touch to find out how.

The answer to this question is entirely dependent on what you need that interior design software to do. The best software will change whether you’re an established interior designer, are just starting out, or just want to carry out a DIY project on your own home. There are many excellent free options for those that just want to design the odd individual project, however, if you are going to be managing multiple larger projects a paid program might be better for you. Many paid versions offer free trials, so shop around before buying, but our favourites are Planner 5D and Cedreo.

Joanna Gaines uses SketchUp which is a fantastic tool, especially for professional interior designers, however, it is pricey. If you didn’t want to splurge quite so much but still wanted a sleek, professional software tool then we recommend Cedreo.

Again, this will be largely down to personal preference and what is most important to you. As a rule of thumb, however, it’s a good idea to look for how easy it is to use (whether straight off the bat or via included tutorials), good customisation options if you’re using the software as a professional, and most importantly, that it’s in your price range.

Interior design software simplifies the planning and visualizing process in designing spaces. Instead of imagining how a room might look with certain furniture or paint colors, these tools can produce digital representations, allowing you to experiment with various design elements before implementing them. Such software is beneficial for architects, designers, and even homeowners who wish to experiment with designs themselves. It helps save time, reduces costs associated with making changes after construction or renovation, and promotes better communication between clients and designers.

While some advanced features in interior design software may require professional training to fully utilize, most of the basic functions are user-friendly and can be learned with some practice. Many software providers offer detailed tutorials, and plenty of online resources are available to guide users. Some software even have drag-and-drop interfaces that are intuitive to navigate. However, for individuals looking to utilize these tools at a professional level, a comprehensive understanding of design principles coupled with formal training in the software can prove advantageous.

Interior design software can create realistic 2D and 3D renderings of proposed design ideas, providing a visual aid that can effectively communicate a designer’s vision to clients. Some software can even create immersive virtual reality walkthroughs, offering clients a unique, interactive way to experience the proposed design. This enhanced visualization capability helps eliminate miscommunication and gives clients a clear understanding of the final outcome, thereby improving client satisfaction and decision-making efficiency.

Yes, many interior design software include features for material and cost estimation. They can calculate the quantity of materials needed for a project, such as paint, wallpaper, flooring, and more. These tools can also estimate the cost of these materials and provide a comprehensive budget overview. This functionality can help designers and their clients make informed decisions about material choices, keeping the project within the desired budget and avoiding unnecessary expenditures.

Collaboration is crucial in any design project. Interior design software often provides features that facilitate collaboration, such as cloud storage, multi-user access, and real-time editing. These tools allow various stakeholders, such as clients, architects, and contractors, to access the designs, provide feedback, and make alterations if needed. This encourages transparent and efficient communication among all parties involved, promoting a smoother execution of the project. Some software even integrate with other project management tools to further streamline the process.