REAL ESTATE

Residential, Commercial, Interiors

LANDSCAPE

Landmarks, Cityscape, Urban, Architectural

FOOD

Hotels, Restaurants, Advertising, Editorial

PORTRAIT

Traditional, Glamour, Lifestyle, Candid

PRODUCT

Studio, Lifestyle, Grouping

EVENT

Conference, Exhibition, Corporate

FASHION

Portrait, Catalog, Editorial, Street

TRAVEL

Landscape, Cityscape, Documentary

SPORT

Basketball, Football, Golf

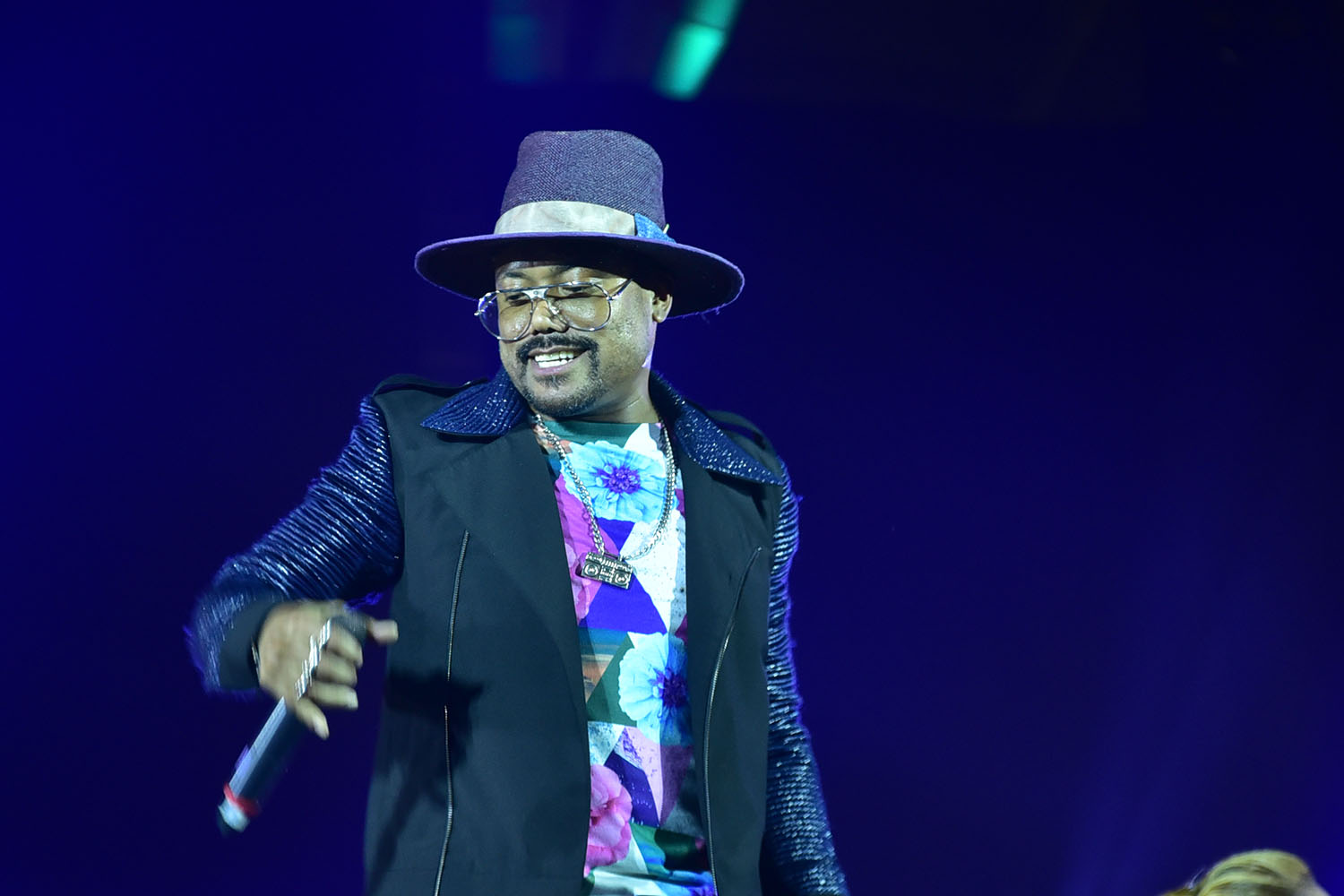

CONCERT

STILL

STREET